We are happy to invite you to 3 webinars series that will discuss how the financial sector can spearhead private sector investment in climate actions in the energy, agriculture and water sectors in selected countries in Africa, Asia and Latin America. Speakers will present current financing instruments available for private sector investment, present findings for financial sector to provide green financing for the private sector, and also have some perspectives from external participants

Upcoming webinar: Friday, 18th December, 2020 at 8:00 A.M - 9:00 A.M. EST

Join the meeting here: https://undp.zoom.us/j/83234529026?pwd=L1BEQnYrNlNhcFdBWU9HZWJuSkpkUT09

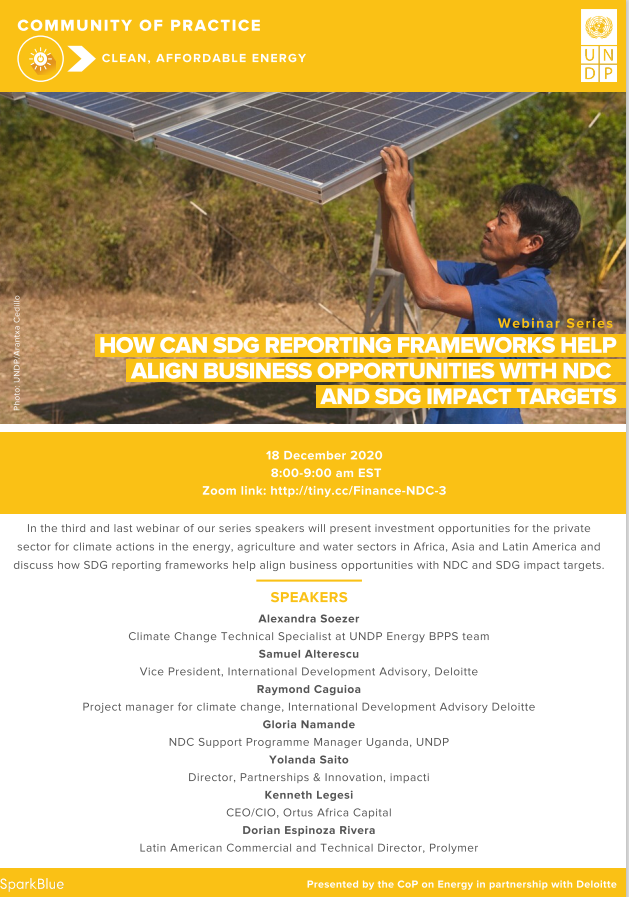

We are happy to invite you to 3rd webinar of a series that will discuss how private sector investment in climate actions in the energy, agriculture and water sectors in selected countries in Africa, Asia and Latin America can accelerator NDC implementation. Speakers will present investment opportunities for the private sector for climate actions in the energy, agriculture and water sectors in selected countries in Africa, Asia and Latin America and discuss how SDG reporting frameworks help align business opportunities with NDC and SDG impact targets.

-----------------------------------------------------------------------------------------------------------------------

Recording of Webinars

Date: 24 November 2020

Speakers:

- Alexandra Soezer, Climate Change Technical Advisor ([email protected])

- Raymond Caguioa, Project Manager for Climate Change, International Development Advisory, at Deloitte Tohmatsu

- Samuel Alterescu Vice President, International Development Advisory, at Deloitte Tohmatsu

- Megumi Sato, Senior Analyst, International Development Advisory, Deloitte Tohmatsu Financial Advisory LLC

- Stanislaus Deh, Head of Structured Product, Personal and Business Banking, Stanbic Bank, Ghana

Questions and Answers session

Given the barriers listed, in terms of supply and demand as well as private investment in energy, what are the priority barriers to be removed to enhance banks’ support to the private sector?

As discussed during the presentation, there are several barriers identified both from the supply-side and demand-side, in terms of investment in the energy sector. All of these barriers need to be addressed to enhance banks’ ability to support the private sector. In terms of priority to enhance the ability of banks to support the private sector, we think that addressing capacity-related barriers such as the high-risk perceptions, lack of experience in project finance and lack of basic finance and accounting skills are barriers that could be addressed in the short-term through enhancing the capacities of the relevant key stakeholders. Barriers such as the lack of long-term financing, lack of equity and lack of financing directly related to green/sustainable projects also need to be addressed, and could be done through blended financing and de-risking mechanisms that could provide favorable investment conditions. Green financing should also be clearly defined through regulations and standards to provide definitive guidance on what qualifies as green financing.

How can we explain to private sector actors what a green project is and what is not? How can we convince stakeholders to mainstream environment considerations into their decision-making?

It is important to have regulatory guidance and standardization on what constitutes ‘green financing’. This should support both the financial sector actors and private sector actors with the ability to determine which activities qualify as green financing/projects. Having this guidance from a policy perspective also encourages stakeholders to mainstream climate change and environmental considerations into their activities. This allows them to see the added value of aligning their activities with how it contributes to their country’s climate targets and sustainable development goals. This could be further elaborated on during the 3rd webinar of the series, wherein alignment of business opportunities with NDCs and SDGs are discussed.

What has been the role of women’s groups in engaging in the distribution networks, particularly in rural areas? What kind of capacity building activities were needed?

UNDP’s gender analysis for Ghana found that women are the most important actors in the renewable energy sector due to their reliance on energy in the households and communities. Biomass, primarily wood fuel and charcoal, constitutes 67% of the total energy consumed in Ghana, which women rely on for cooking and heating. Without access to modern energy services, rural women spend hours performing basic subsistence tasks, which constrains them from accessing decent wage employment, educational opportunities and livelihood enhancing options, and also may lead to illnesses from indoor air pollution caused by the biomass fuels. As for gainful employment in the energy sector, women are primarily active in the lower-paid, non-technical fields such as administration, finance, marketing and public relations. Women’s economic contribution (ex. woodfuel collection) to the energy sector is usually unaccounted for as it is unpaid, unrecognized and undervalued. It is crucial to understand the gendered patterns of access, consumption and management of energy as women have the knowledge and skills as primary energy consumers to contribute to sustainable and clean energy solutions. Promoting women’s leadership in renewable energy programmes, such as through training women entrepreneurs to provide renewable energy for rural households, will not only help women’s economic autonomy by providing a source of income, but will offer them the opportunity to actively drive sustainable development within their communities.

Thank you very much Stanislaus for sharing your experience from Ghana. I would like to know if there is a national framework that facilitates your activities? Do you get any specific incentives from the government?

There is a Nationally Determined Contribution private sector National Steering Committee that I serve on. This gives me a good opportunity to learn and understand the Programs of Action and progress being made in each sector. The knowledge from such meetings is helpful to the bank in developing solutions to serve the financing needs of government, private sector businesses and individuals towards achieving the grand objective of becoming a low carbon and resilient economy. In terms of specific incentives, a lot more can be done by government to support. Active implementation of Climate Change Policy Instruments such as tax incentives, guarantees, grants, concessionary loans, Feed in Tariffs and active working relationships with financial institution will all be helpful.

How effective have you found the project aggregation and standardization platform in mobilizing private investment? Could you share a success story and direct us to where we can find the platform?

To increase the interest of investors in projects, we see the need for (1) standardisation of smaller projects, so they can be analysed through the same lens, compared, and have the same metrics and (2) the need for aggregation so that projects can potentially be pooled for investors to address the issue of investment size.

For this to happen, companies need robust tools and innovative platforms. Platforms such as Odyssey offer technical and financial tools which shall help developing, financing and managing distributed energy systems at scale. Through these platform, financial reports, technical analysis, visualizations and live system data feeds can be imported and analyzed in a customized diligence platform, to standardise the projects and prepare them for deal assessment by investors.

More information about Odyssey Platform can be found here.

The link to the Odyssey Platform can be found here and a list of ongoing initiatives can be found here.

Anything related to hedge financing against local currency, especially in countries where local banking sector is illiquid and has high FX volatility?

Although hedge financing is was not directly touched upon, the study focused on de-risking mechanisms that would allow the provision of capital at favorable conditions and enable long-term financing. Leveraging blended finance is one of the recommendations provided. Affordable short-term debt could be leveraged to reduce the cost of capital, and partial credit guarantees could be utilized to mitigate risks of default in the longer-term.

Specific to local currency risk, it is possible to leverage local financing (eg. in local currency) and hedging mechanisms (FX guarantees exist, especially for large projects). Leveraging local financing is explored in depth in some of the reports. It is important to further develop local bond markets and support the development of local green financing capacities for this.

Any views on identification and costing of the requirements of the technology/infrastructure enabling environment (e.g. trade standards, corruption control, contract enforcement, support to local production, etc.). Do the cost metrics of the enabling environment differ in accordance to the sector, technology type, etc.?

The associated costs of setting up the enabling environment to encourage the finance sector and private sector to enhance investments in climate action was not included in the scope of the study. Nonetheless, this is an important point for consideration which would be supported through future technical assistance.

What about venture capital that provides more patient risk capital that is more apt for "green" investments compared to traditional commercial banks?

Venture capital, as well as corporate venture capital and impact investors were cited as one of the recommendations and entry points for the private sector in the study. Venture capital could play a key role in de-risking innovative social models and providing capital with favorable conditions to innovative enterprises. This could be done through leveraging acceleration and incubation services, as well as accessing grants and concessional finance to drive green investments.

However, it is unlikely that venture capital will provide what is “patient capital” (eg. Debt with longer tenors, grace periods and other mechanisms to allow for delayed cashflows). Some impact investors may seek longer term tenors and returns.

Please log in or sign up to comment.